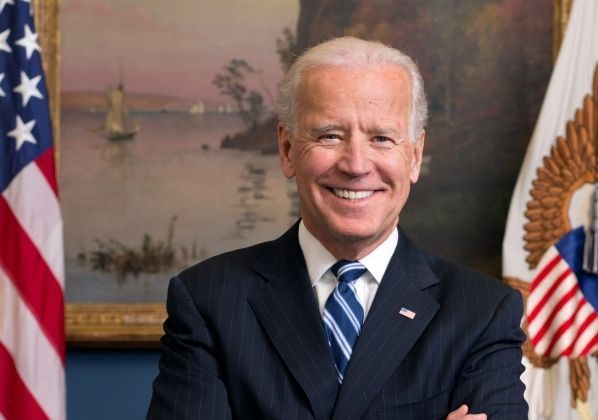

President Biden spoke at the Brookings Institute in Washington D.C.

Biden was Monday’s KVML “Newsmaker of the Day”. Here are his words:

“Last month, I spoke to the Economic Club of Washington D.C. about the pivotal actions we took to rescue the economy from the devastating harm caused by the — by the way the — in my view, the pandemic was handled and how we delivered immediate economic relief to those most in need. We got back to full employment, got inflation back down, managed the soft landing that most people thought was not very much likely to happen.

Today, here at Brookings Institution, I would like to talk about pivotal actions we’ve taken to rebuild the economy for the long haul, you know, and how we’re — how we’re at a critical, in my view, moment in the direction the economy is going to take.

Next month, my administration will end and a new administration will begin. Most economists agree the new administration is going to inherit a fairly strong economy, at least at the moment — an economy going through a fundamental transformation that’s laid out a stronger foundation and a sustainable, broad-based, highly productive growth. And it is my profound hope that the new administration will preserve and build on this progress.

Like most grace [great] economic developments, this one is neither red nor blue, and America’s progress is everyone’s progress.

After decades of trickle-down economics that primarily benefitted those at the very top, we — we’ve written a new book that’s growing the economy — the middle-out and the bottom-up — that benefits, thus far, everyone. And that’s going to be the test with go- — going forward.

Over 16 million new jobs — that’s new jobs — the most in any single presidential term in American history; the lowest average unemployment rate of any administration in the last 50 years; 20 million applications for new business records — I mean, it’s — it’s for a new business — for ri- — that is a record, I should say; stock market hits record highs. I wish I owned a lot of stock. (Laughter.)

You know the worst part of all this that I can acknowledge at Brookings? For 36 years, I was listed as the poorest man in Congress. (Laughter.) What a foolish man.

Anyway, 401(k)s are up. More than a trillion dollars in private-sector investment in clean energy and advanced manufacturing in just two years alone. After decades of sending jobs overseas for the cheapest labor possible, companies are coming back to America, investing and building here, and creating jobs here in America, in my view, where they belong.

And, of course, this economic growth is not without pain. The entire world faced a spike in inflation due to disruptions from the pandemic and Putin’s war in Ukraine.

We acted quickly to get inflation down with the help of Republicans and Democrats. Inflation came down to pre-pandemic levels. Wages have increased.

But still, too many working- and middle-class families struggle with high prices for housing and groceries and the daily needs of life.

At the same time, as inflation and interest rates continue to fall, we’ve entered a new phase of our economic resurgence.

With the outcome of this election, we also face an inflection point: We do — do we continue to grow the economy from the middle out and the bottom up, investing in all of America and Americans, supporting unions and working families as we have the past four years? Or do we — or do we move backward — in my view, backslide to an economy that’s benefitted those at the top, while working people and the middle-class struggle to — for a fair share of growth and economic theory that encouraged industries and live- — livelihoods to be shipped overseas?

And I might add, I’m not anti-corporation. For 36 years, I represented corporate America. I — my state has more corporations in — registered in my state than every other state in the Union. So, I’m mildly accustomed to corporate America, and to see it grow is useful and helpful and necessary.

But to make the most of the opportunities ahead, I want to share key pages from our middle-out, bottom-up economic playbook and lay down what I believe to be a new set of benchmarks to measure against the next four years and see whether this theory is more than just a phenomenon.

Four years ago, when I came to office, 3,000 Americans were dying per day from the pandemic that infected and the- — had profound effect on our economy — not only ours but around the world. Millions of Americans lost their jobs, were at risk of losing their homes. Hundreds of thousands of factories and businesses — excuse me — yes, hundreds of thousand closed and — creating despair in communities.

I remember I — when I was campaigning and they’d say, “My dad used to work at that factory. My grandfather worked at that factory. It’s gone.” People lost hope. They lost hope, and particularly through the Midwest and other areas of the country.

Supply chains was shattered. Prices soared on everything from cars to homes to appliances.

The previous administration, quite frankly, had no plan — real plan — to get us through one of the toughest periods in our nation’s history.

In fact, there’s an old saying, “If the only tool you have in your toolbox is a hammer, everything looks like a nail.”

Over the course of decades of Republican leadership and — and I’m not a — those of you who know anything about me and my career in the Senate, I had as many Republican friends as Democratic friends, for real. I’m not — I’m not of these — anyway, I won’t get going. (Laughter.)

But I’ve never been a big fan of trickle-down economics. The w- — it was a hammer that was hammering working people.

My dad used to say — my dad was a well-read — well-read man who didn’t get to — he got accepted to go to Hopkins and — but during the war, he never got to go. But my dad used to talk about — he said, “Dad” — “Joey, not a whole lot trickles down on my kitchen table at the end of the month.”

Slashing taxes for the very wealthy and the biggest corporations, diminishing public investment in infrastructure, in education, in research and development.

And keep your eye on it. We’re going to find out whether or not what they want to do on each of those areas — continue to slash — makes sense or not.

Offshored jobs and factories — I took off- — for cheaper labor overseas.

Destroying unions while imposing costs on — on those products made in America.

And despite the mythical reputation to pay for itself, trickle-down economics deeply worsened our fiscal outlook, in my view.

To offset the costs, advocates of trickle-down economics ripped the social safety net by trying to privatize Social Security and Medicare, trying to deny access to affordable health care and prescription drugs.

Lifting the fortunes of the very wealthy often meant taking the rights of workers away to unionize and bargain collectively.

And, by the way, I’m all for the very wealthy. I’m not joking. If you can make as much money as you can, good for you. But everybody’s got to be — pay — pay their fair share.

It meant rewarding short-termism in pursuit of short-term profits, extraordinary high executive pay, instead of making long-term investments, in many cases.

As a consequence, our infra- — our infrastructure fell further behind. A flood of cheap imports hollowed out our factory towns.

Remember “Infrastructure Week”? We had Infrastructure Week for four years. Nothing got built.

Well, everybody said when I wanted to have an infrastructure bill that mattered — over a trillion three hundred billion dollars — we’d never get it done. We got it done.

The next president has a game plan I laid out. And, by the way, he’s going to find, since I made a promise I’d invest as much in red states as blue, he’s going to have a trouble not doing it. He’s going to have a lot of red state senators who were opposed to all of it and didn’t vote for it deciding it’s very much in their interests to build the facilities that are on this (inaudible).

Economic opportunity and innovation became more concentrated in few major cities, while the heartland and communities were left behind.

Scientific discoveries and inventions developed in America were commercialized in countries like China, bolstering their manufacturing investment and jobs instead of the economy.

Even before the pandemic, this economic agenda was clearly failing. Working- and middle-class families were being hurt.

The pandemic and the economic crisis revealed a failure for everyone to see and to feel.

And, you know, one of the things that’s going on here — (the president’s teleprompter shuts off) — they just turned off my — I’m going to go off my — I lost the electricity here.

But anyway, one of the things we found is that, you know, we — we invented the semic- — the computer chip, the size of the tip of your little finger, to power our everyday lives, from vehicles to advanced weapons, cell phones, everything in between.

The United States invented these computer chips, but over time, we stopped making them. In the very beginning, we had — we produced 40 percent of them in the world.

Well, they all went overseas, almost — virtually all.

So, when the pandemic hit, we found out how vulnerable America was. Supply chains abroad got shut down in the Far East because people got sick. The factories making the chips closed. And all of a sudden, everybody started learning about supply chains, a phrase that was probably used more in the last four years than the last 40 years. No, I’m serious.

You couldn’t get these chips. Prices soared.

For example, it takes over 3,000 chips to build an American automobile — 3,000. But when the overseas factories making those chips shut down, the production stopped and the cost of new cars soared.

You know, it didn’t have to be that way, and I was determined to change that.

I remember looking at my staff and saying, “I’m going to South Korea.” And they said, “You’re what?” Oh, you think I’m kidding. See the guy next to you? He’s a brilliant economist. (Laughter.) He didn’t think I was so brilliant going overseas there. (Laughter.)

But all kidding aside, I came into office with a different vision for America that’s been consistent with my record — good, bad, or indifferent — since I’ve been a senator: grow the economy from the middle out and the bottom up; invest in America and American products. And when that happens, everybody does — the wealthy still do very well, and all of America, no matter where they lived, whether they went to college or not.

I was determined to restore U.S. leadership in industries of the future.

You know, four years later, we have proof that the playbook is, at least now, working.

You know, within the first two months of office, I signed the American Rescue Plan — the most significant economic recovery package in our history — and I also learned something from Donald Trump. He signed checks for people for 7,400 [1,400] bucks because we passed the plan. And I didn’t — stupid. (Laughter.)

But all kidding aside, I realize we’re talking about the impact of politics, but the economic basic principles is what we’re (inaudible).

You know, we helped vac- — that — passed that act, we helped vaccinate the nation and has returned to full employment.

This was just the beginning.

We understood we needed long-term investments for the future. Investing in America agenda, which includes my Bipartisan Infrastructure Law, CHIPS and Science Act, the Inflation Reduction Act — together, they mark the most significant investment in America since the New Deal. And that’s a fact. I mean, whether it’s good or bad, that’s the fact.

The Inflation Reduction Act alone is the most significant investment in climate and energy ever, ever anywhere in the entire world. We were told we couldn’t get it done. We got $368 billion.

We make these investments — when we make them, we buy America. “Buy American” has been the law of the land since the ‘30s. I won’t go back — it takes too much time, but you go back to the laws Lincoln pass- — Lincoln, my lord — if you go back to the laws that Roosevelt passed about allowing unions to resist being stepped on and organize, well, there’s a prevision — a “Buy America” prevision.

I was a senator for a long time. I thought I was pretty informed. I didn’t know it existed.

And, by the way, former presidents didn’t know. If they knew, they didn’t say anything about it.

It says that the money that a president authorizes, that Congress has spent, should be used by the president to hire American workers and buy American products.

There was an exemption. If you couldn’t find the American product, American worker, you could go overseas, but you had to show it.

Well, guess what? Past adminiscration, including my present [predecessor], failed to “Buy America.” But not on my watch.

We’re modernizing our roads; our bridges; our ports; our airports; our clean water system; affordable, high-speed Internet systems; and so much more.

And, by the way, if you think about the high-speed Internet systems, they’re as consequential to farmers as electricity was during the — during the administration of — of Roosevelt. I’m serious. You can’t function without it.

And we’ve incentivized building all these large federal projects within — with American products and American union — mostly union labor, new pathways into these jobs, including a record number of registered apprenticeships that we’ve made sure occurred.

As I noted earlier, when I came to office, semiconductor manufacturing had moved overseas. I was determined to bring it back so we wouldn’t be at the end of the supply chain; we’d be beginning of the supply chain. And that’s what we’ve done with my CHIPS and Science Act, which has attracted $350 billion in private-sector investment in America, including from Korea and from Taiwan.

These — I remember when we went to — to — I digress; I shouldn’t because it’s a long speech, but to digress just a moment — I went to South Korea and I met with Moo- — Yoon and — and I met with Samsung.

I said, “Why are you making this billions-dollar investments in — in what we call the ‘Field of Dreams,’ outside of Columbus, Ohio?” He said, “Because you have the most capable workers in the world, and it’s the safest place in the world for me to make my investment.”

These investments are building what they call a new “fab.” You all know this. But a fab is — new factories. But they’re these giant, giant things as big as football fields. And guess what? When they’re built, they employ thousands of people. And guess what? The average ...

Read More Details

Finally We wish PressBee provided you with enough information of ( Biden: My Middle-Out, Bottom-Up Economic Playbook )

Also on site :

- Walmart Is Selling a 'Beautiful' $96 9-Drawer Dresser for Just $49, and It Holds a ‘Shocking’ Amount of Clothes

- Trump announces new round of US-China trade talks

- Tottenham sack Postecoglou despite Europa League win