Recent analyses of Bitcoin's market dynamics suggest a promising trajectory, potentially indicating a price increase of up to 62%. With Bitcoin currently trading around $105,000, various market indicators have sparked optimism among analysts. Key factors contributing to this bullish sentiment include significant institutional adoption and favorable economic conditions, particularly anticipated Federal Reserve rate cuts influenced by labor market data .

Interestingly, despite the short-term volatility, several key technical indicators now point to a potentially bullish setup. In fact, this latest pullback appears to complete a series of signals that historically precede major price rallies.

Bitcoin Set For Price Surge, First Target At $130,000

In an X post on June 6, a market expert with X username CrypFlow shares a bullish Bitcoin prediction amidst an ongoing price correction.

Aside from sharp price decline in the past week, the BTC market has witnessed a steady price correction since the premier cryptocurrency achieved a new-all time high of $111,970 on May 22. However, CrypFlow states that this price retracement alongside a host of other technical indicators suggest that Bitcoin is setting to repeat its price rally from Q4 2024.

“A stronger-than-expected report might delay rate cuts, strengthening the dollar and possibly exerting downward pressure on Bitcoin,” Bitfinex analysts said.

However, they added that a “softer-than-expected” report could reinforce the “disinflation narrative” and encourage the Federal Reserve to consider reducing interest rates sooner, which would be bullish for Bitcoin.

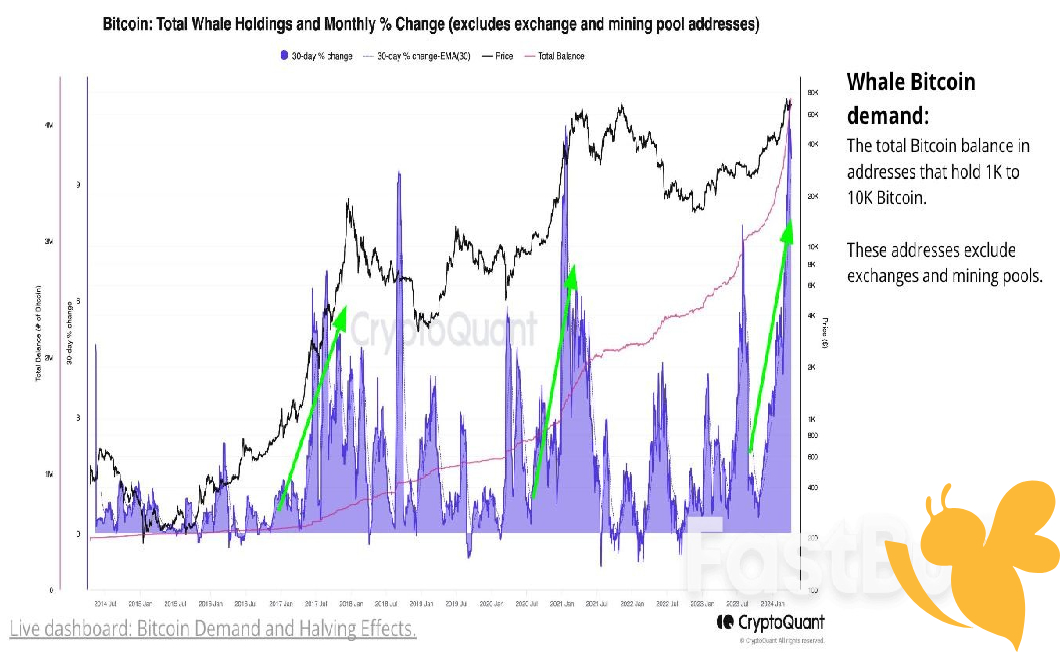

One of the most compelling signs for this potential price surge is the behavior of large investors, colloquially known as "whales." Increased accumulation by these entities has historically correlated with upward price movements in the cryptocurrency market . Furthermore, robust inflows into U.S.-based spot Bitcoin ETFs reflect growing investor confidence and interest in Bitcoin as an asset class . These developments collectively suggest that Bitcoin may have substantial room for further expansion.

In conclusion, while predicting exact price movements in volatile markets like cryptocurrencies remains challenging, current data points towards a significant possibility for Bitcoin to achieve a notable increase. Continued monitoring of investor behavior and macroeconomic trends will be crucial in assessing the sustainability of this bullish outlook .

Read more

Dvalishvili and Harrison Victorious at UFC 316 Trump warns Musk of 'serious consequences' following dispute over spending billSara H

Also on site :

- Bitcoin data suggests possible 62% price surge

- Beyond the Game: Haier Vision for Youth and Sustainability

- Apple, Oracle, Adobe and inflation: Stocks and economic data to watch this week